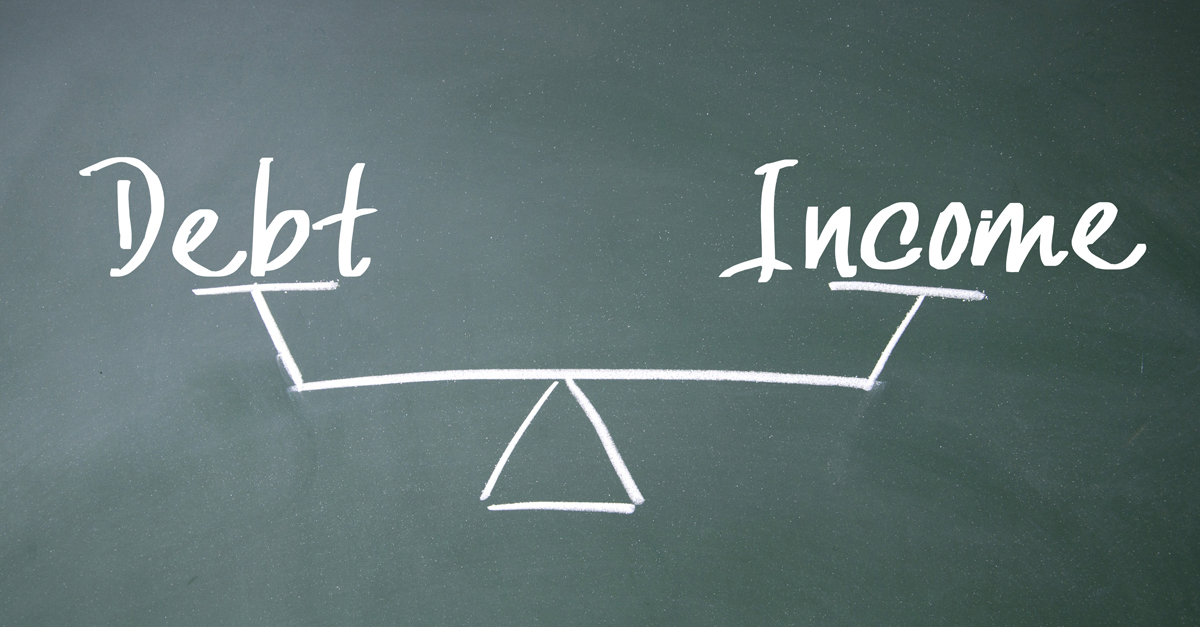

30+ debt-to-income ratio mortgage

Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Web Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Debt To Income Ratio How To Calculate Your Dti Nerdwallet

Plug your numbers into our debt-to-income ratio calculator above and see where you stand.

. A DTI of 43 is typically the highest. If your home is highly energy-efficient. Youll usually need a back-end DTI ratio of 43 or less.

Web Your back-end ratio. Now its your turn. Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt.

Web Here are debt-to-income requirements by loan type. So Bobs debt-to-income ratio is 32. If your total monthly debts including your future mortgage payments student loans car payments and other obligations are 2000 and your gross monthly income is 4000 your back-end ratio would be 50 2000 4000.

Lenders prefer to see a debt-to. Web Your front-end or household ratio would be 1800 7000 026 or 26. Web How much house you can afford with a 60000 per year salary depends on home prices in your area your debt-to-income ratio and your creditworthiness.

Web To qualify for an FHA loan you generally must have a FICO score of at least 580 and a debt-to-income ratio DTI of 43 or less including student loans. Reverse mortgages do not consider it for approval though. Web As a general rule your debt-to-income ratio should remain below 36.

This divides all your monthly debt payments housing included by your gross monthly income. Youre in Good Hands. Web How to do a debt-to-income ratio check Step 1 Enter all your personal loan expenses into our calculator.

Mortgage lenders use debt-to-income ratio or DTI to compare your monthly debt payments to your gross monthly income. Our Service is Rated Gold by Investor in Customers. Web Debt to income ratio DTI is calculated as the following.

Youre in Good Hands. Web Debt-to-income ratio represents what percentage of your income goes to debt repayment each month. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. To get the back-end ratio add up your other debts along with your housing expenses. The rule says that no more than 28 of your gross monthly income.

Total monthly debt payments total gross monthly income Multiply this amount by 100 to convert it to a recognisable. Heres how lenders typically view DTI. Youll see there are slots for mortgage personal loans.

Homeowners Aged 55 Would You Like to be Free of Monthly Mortgage Repayments. Homeowners Aged 55 Would You Like to be Free of Monthly Mortgage Repayments. Web Buyers who want a low interest rate and smaller monthly payment may want to lock in a 30-year mortgage today ahead of likely rate fluctuations.

Web What is a debt-to-income ratio. Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses. Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt.

So with 6000 in gross monthly income your maximum amount. Multiply that by 100 to get a percentage. Our Service is Rated Gold by Investor in Customers.

Take those same numbers above a down payment of 30000 on a 30-year fixed interest. Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent.

Aktualisiert Kreditunternehmen Auf Mintos Berichten Uber Ihre Finanzergebnisse 2020

Can I Still Get A Mortgage With Student Loan Debt Homewise

How Your Debt To Income Ratio Can Affect Your Mortgage

Debt To Income Ratio How To Calculate Your Dti Nerdwallet

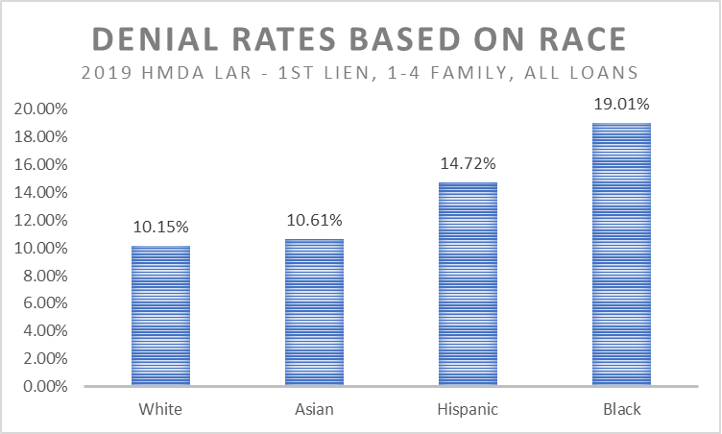

Using Special Purpose Credit Programs To Expand Equality Nfha

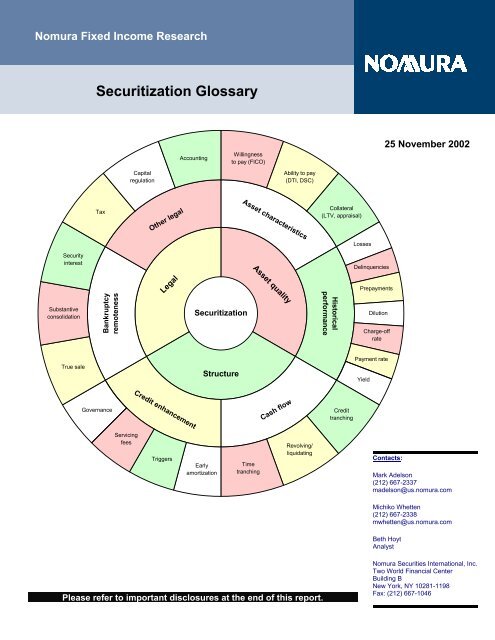

Securitization Glossary Mark Adelson

What Is An Acceptable Debt To Income Ratio Hoyes Michalos

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Dti Ratio Calculator Money

What Is The Debt To Income Ratio Learn More Citizens Bank

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Investing In Real Estate Module 7 Of Family Financial Freedom

Calculated Risk Update Household Debt Service Ratio At Lowest Level In 30 Years

How Debt And Income Affects Mortgage Affordability Homewise

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

22 Mistakes Nearly All First Home Buyers Make Hunter Galloway

Rising Council Debt Across New Zealand